Valpak® and market research firm PureSpectrum partnered up once again to zero in on consumer holiday shopping season habits and behaviors. Survey findings show that, in line with last year, there continues to be an overall desire to maintain holiday purchases this year. Use this data to understand how shoppers approach holiday spending and to develop a better holiday marketing strategy.

Let’s begin

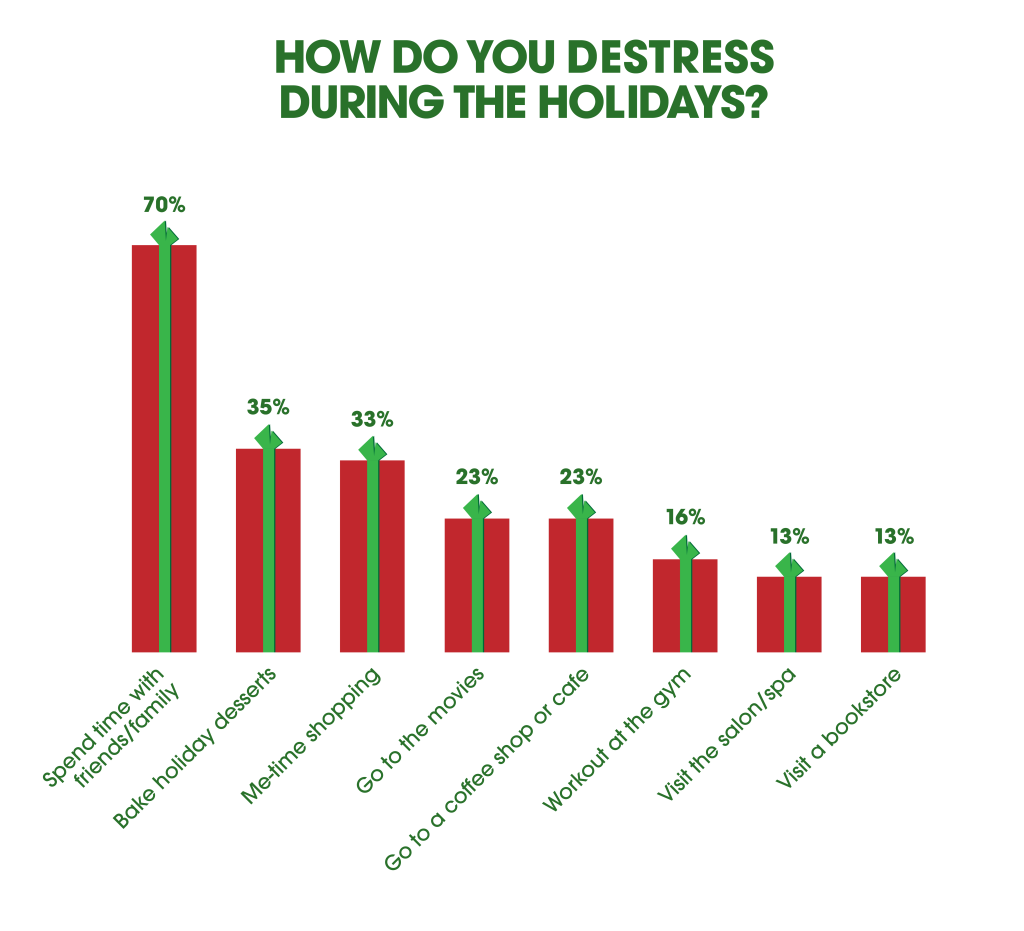

One thing people often forget as they rush to please loved ones during the holiday madness is themselves. Not only do we do some self-reflection during this time of year, but we also deserve some self-care. So, our first big question before we forget about ourselves while thinking about others is ways to destress during the holidays. 70% of Americans plan to spend time with friends / family during the holidays to achieve that so-needed destressing. Last year, in second place (33%), consumers opted for a bit of me-time shopping (i.e., retail therapy), with the utmost honesty, to unwind during those chaotic days. However, pleasing loved ones with a bit of confectionery creation, such as baking holiday desserts, took that spot this year with 35%. Companies can boost their holiday spirit by offering discounts and deals to those seeking holiday help and healing.

“I really enjoy the holiday season. I really wish that stores or businesses would lower prices instead of raising prices during this time.”

Americans’ holiday shopping plans

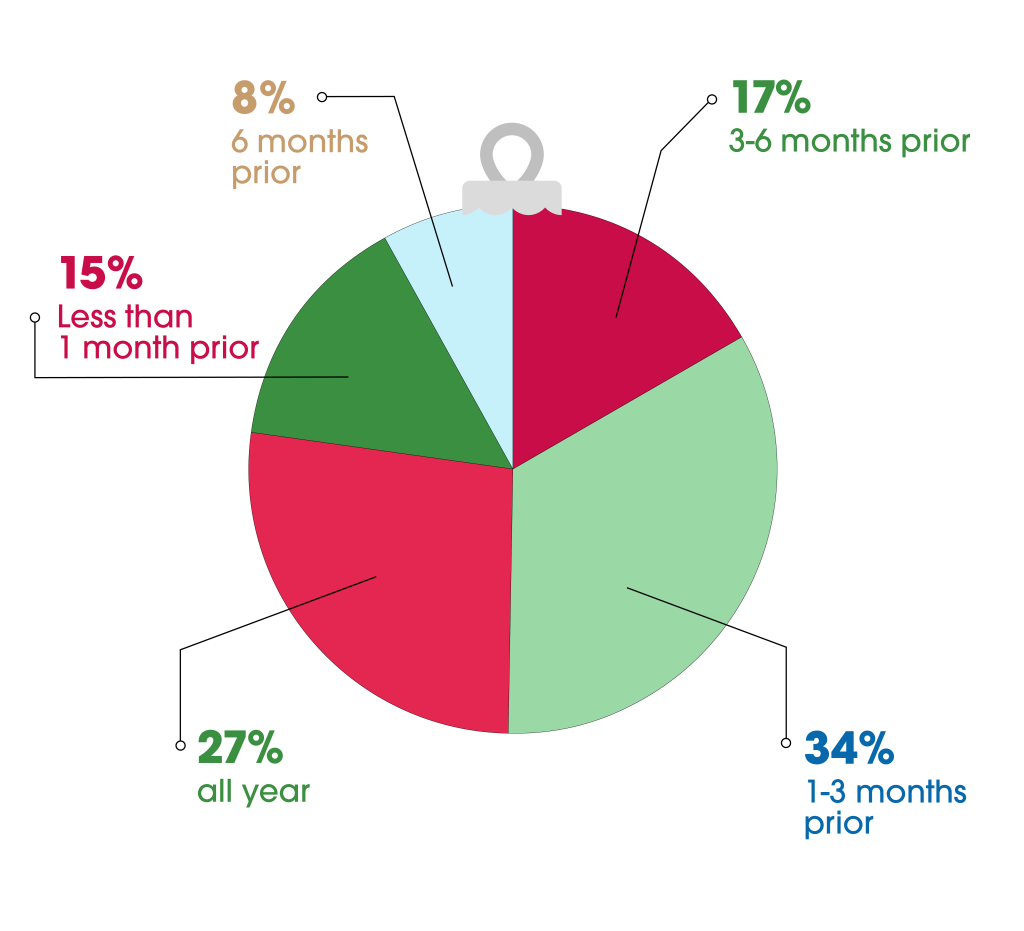

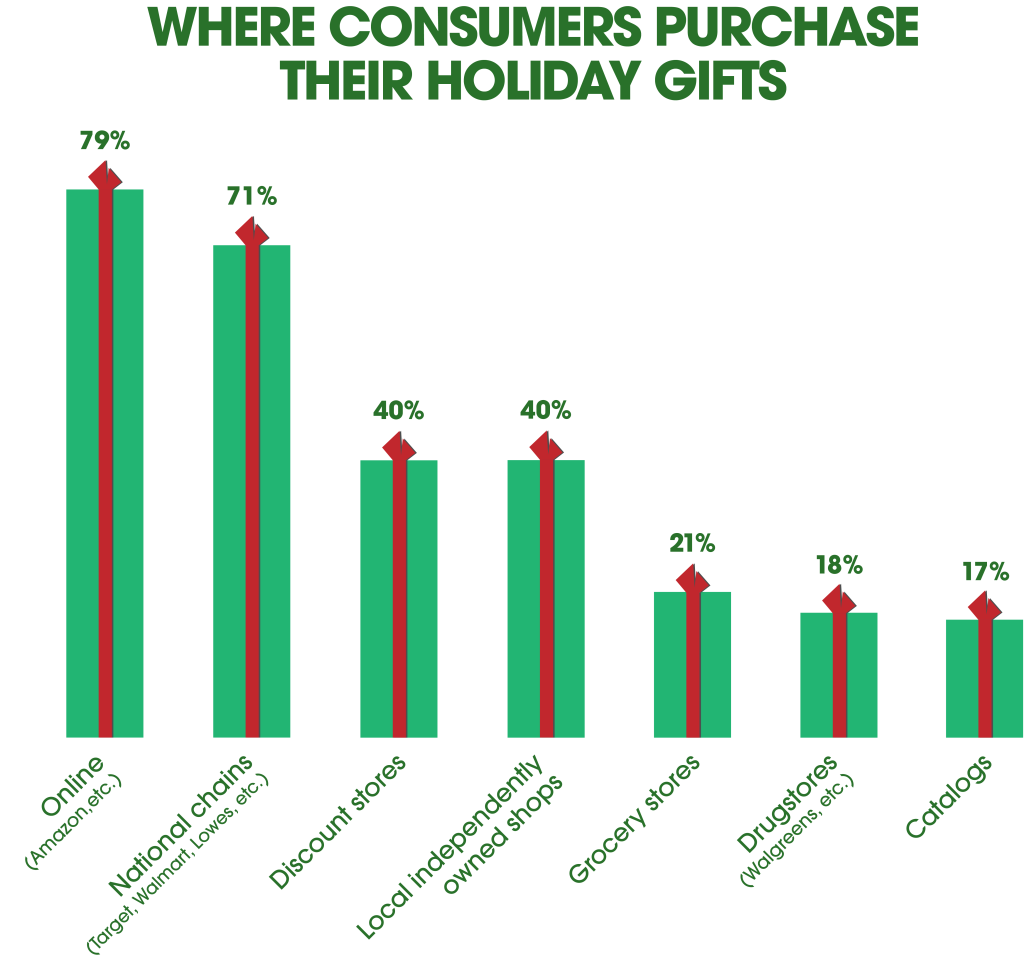

74% of respondents purchase at least some holiday gifts before November, while 27% shop for the holiday season year-round. When it comes to in-store or online shopping, average responses in past holiday surveys have shown a reasonably even split between in-store and online shopping, meaning that the game is pretty much on year-round. Businesses that capitalize on this behavior by always advertising can benefit most—and then make a killing once the holiday rush rolls around.

More than half of Americans surveyed (63%) plan to save money by shopping on major spending holidays. The most popular holiday shopping day for consumer spending is Black Friday, followed closely by Cyber Monday.

Holiday shopping behaviors

83% of respondents purchase gifts from stores they normally don’t shop at during the holiday season (at least sometimes).

This was a common theme, with 58% making gift-buying decisions based on finding the lowest price.

There is no question that data-backed strategies, a smartly designed campaign combined with properly placed promotions that find the right audience at the right time (when potential consumers are actively searching for products and services) bring in new customers that share a high probability of becoming loyal / returning customers if the discounts and deals promised deliver.

Most popular holiday sales / offers

The survey finds U.S. consumers want (even expect) free or discounted shipping offers when holiday shopping – and no, not just from Amazon and Walmart.

When asked how they prefer to receive holiday sales coupons, over half of consumers (71%) prefer to receive holiday coupons / offers in the mailbox or inbox—9% have no preference (give me all the coupons!).

Motivating factors

If you discount, they will shop. A great way to motivate shoppers to show up and spend a little more at your business is to offer some impossible-to-pass-up holiday offers. 46% of our respondents requested more purchased deals ($10 for $20 worth of product) value like these here as their #1 reason to shake loose a few dollars from the money tree this holiday season. Next, the ultimate stimulus we all hope for when we head out to buy gifts is pre-Christmas markdowns (44%)!

Holiday budgets – Americans spending less

“I’d like to do more / spend more but just don’t have the money for it.”

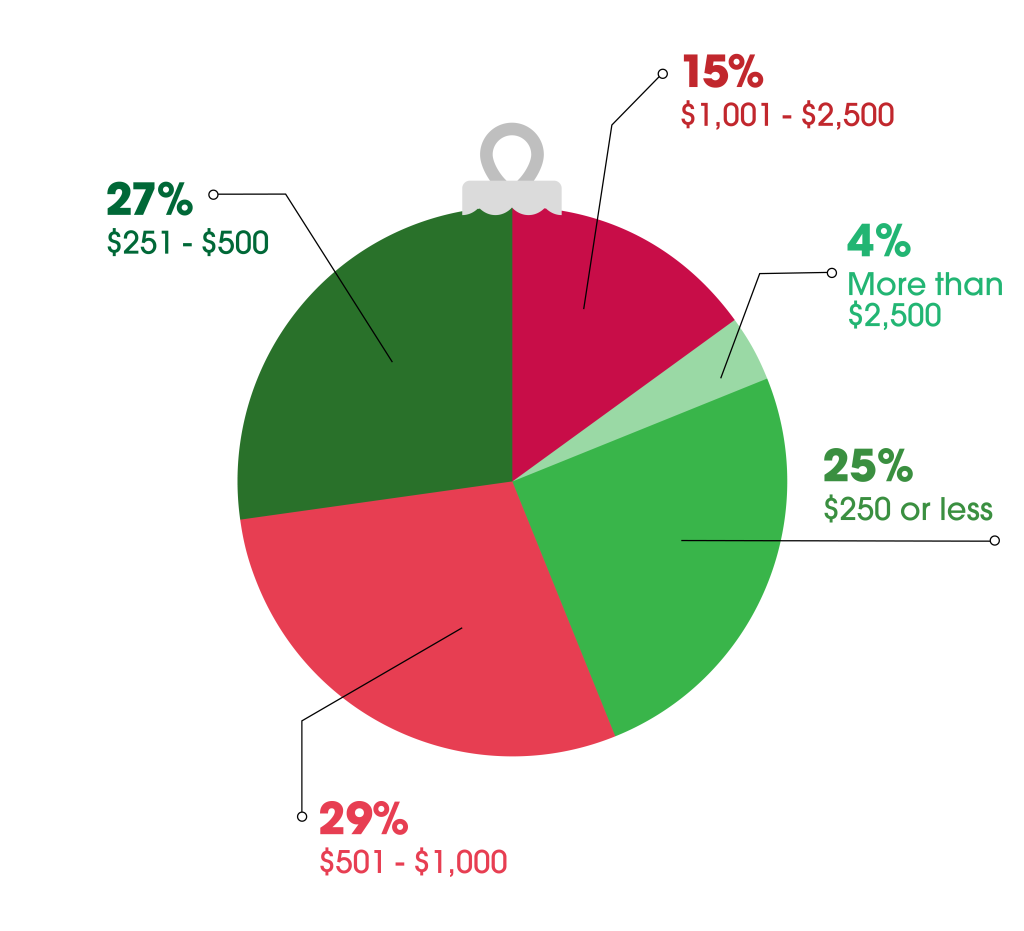

Even though the recent public health scares are thankfully behind us, inflation and other economic disruptions continue to drive consumer spending down. However, things may be ticking up as more and more companies recognize flatter sales due to what feels like endless higher prices and have started to compete for those consumer dollars with well-publicized deal battles. 48% of respondents plan to spend more than $500 on holiday gifts this year, vs. 38% last year (10% increase!).

While there are positive signs for retailers and sellers, despite economic uncertainty and higher prices (which seem to be easing, albeit not enough), 13% of the consumers we asked plan to spend more this holiday than last. 66% say they’ll most likely spend the same amount, but nothing is ever set in stone, especially when great deals and discounts are advertised and messaged as the major holidays draw near. Moreover, it’s beginning to look a lot like Christmas as Americans appear to be feeling a little more generous but a lot more cautious when it comes to prices. Thus, finding and targeting the right audience at the right time may be paramount to sales this season—maybe even more than in previous years!

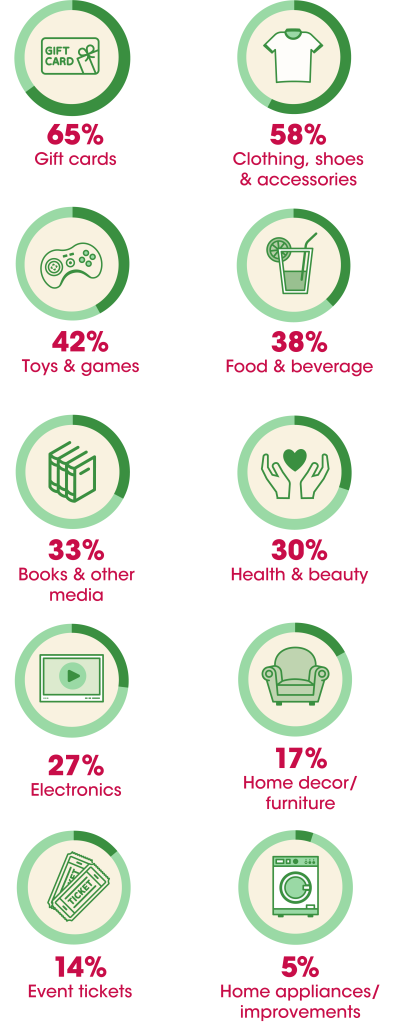

Most popular gifts this holiday season

Gift cards (65%) regained the top spot this year as the most popular holiday gifts, with no shipping delays or supply chain issues to worry about. Clothing, shoes, and accessories took the second place spot with 58%. One thing to note here: things are continuing to move back to normal, and it’s nice to see folks feeling confident about how they can get what they want when they want it again.

Holiday dining trends

With the stress and effort of holiday shopping (not to mention holiday travel), home-cooked meals become less of a priority, as 45% of our respondents said they plan to eat out at least 3 or more times during this holiday season (that’s up 5% from last year!)

And it’s not just hams and Yule logs they’re after. People are excited about non-traditional holiday dining, and where they plan to eat out and would like to receive money-saving dining coupons is almost evenly split across the available restaurant genre options. On that, 94% of consumers want holiday coupons for restaurants, and, surprisingly, the top begins with pizza, then moves to Italian, to steak / prime rib, to Mexican. Moreover, the list of coupons desired for holiday eating enjoyment is open for opportunity:

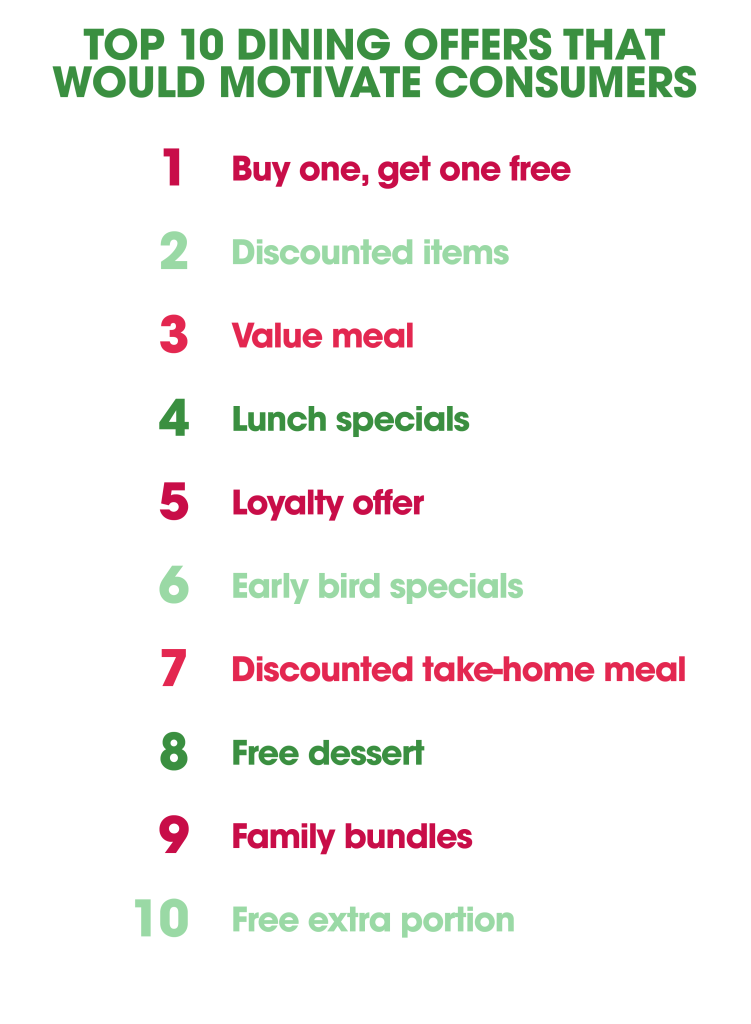

Sprinkle on the incentives

They’re hungry for good food and equally good times dining out. However, with the wide variety of cuisines desired, here is another chance to sweeten the advertising deal with a little motivation, as 94% of consumers agree they’d be motivated even more with a deal / discount. Buy one, get one free is the most popular with hungry consumers (72%), followed by discounted menu items (49%), yet possibly one of the biggest ad pushes during the holiday season are those value meals (46%).

Other holiday coupons wanted

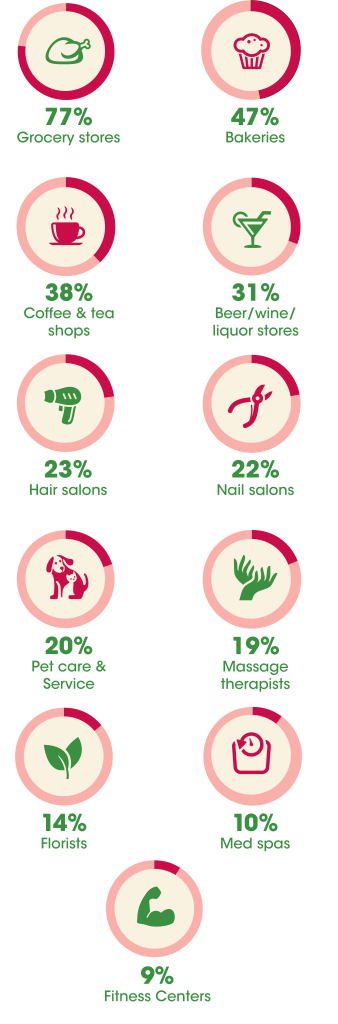

Of course, it’s not just dining; people want coupons from other businesses they plan to shop at over the holiday season. With the rising prices in the aisles, grocery store coupons took the top spot a third year in a row (77%), leading the need by a significant margin. Then, no shock here, bakeries (47%) and coffee and tea shops (38%) for those who take a break and relax during the holiday rush.

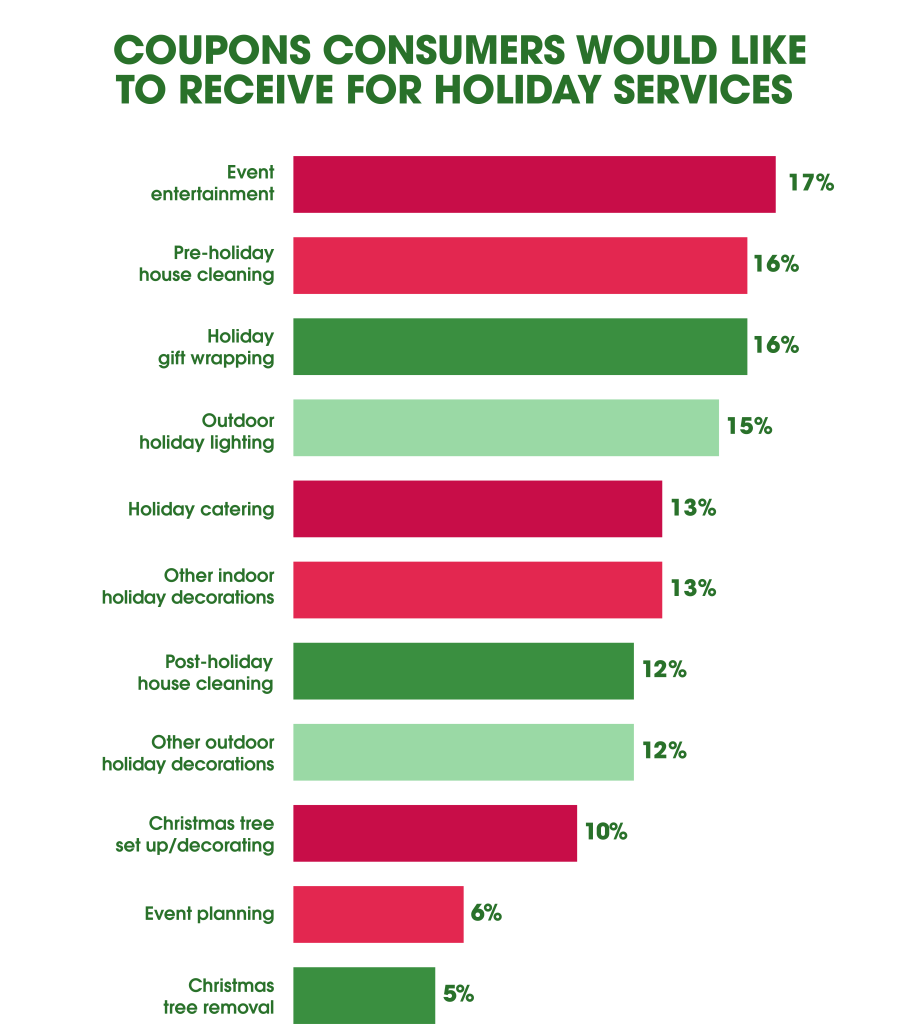

Holiday cleaning & decorating

82% of our respondents will or are considering getting into the holiday spirit by decorating their homes for the holidays. While most are do-it-yourselfers, some have or would consider hiring professional help for holiday hosting, cleaning and decorating. Event entertainment (17%) is the most popular of these services.

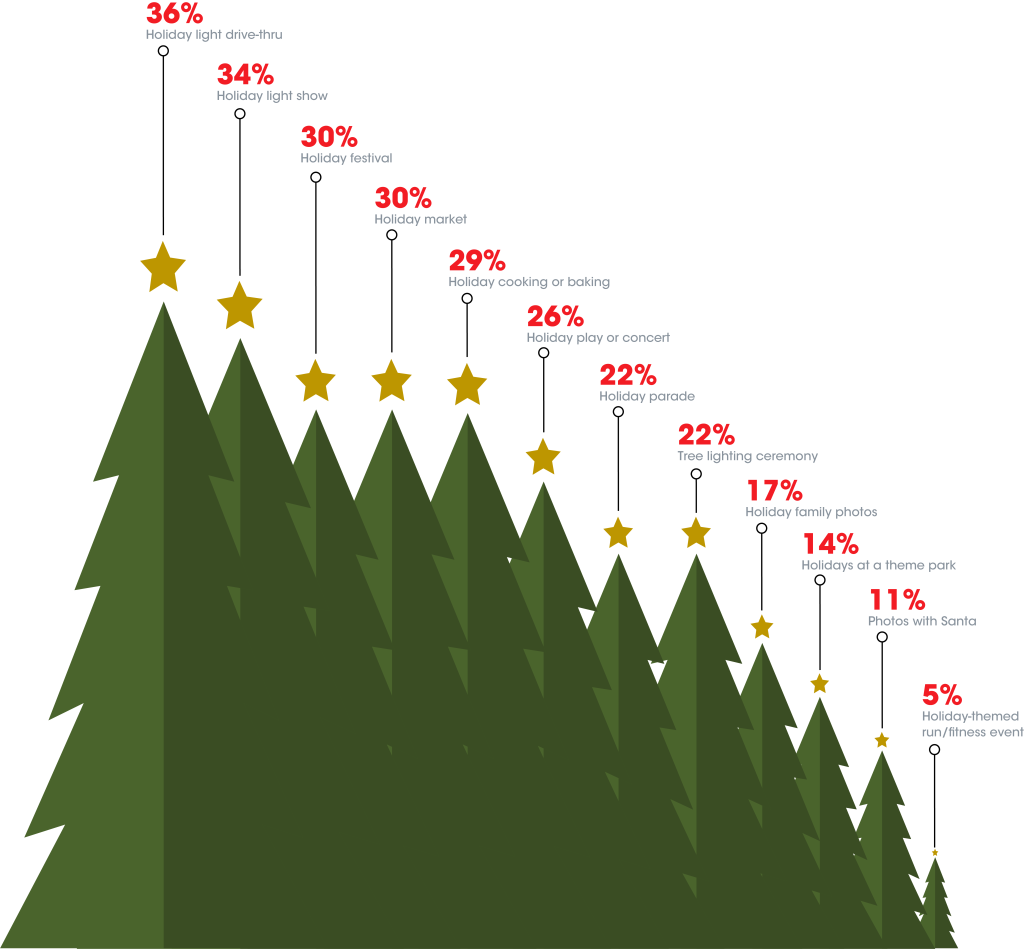

Holiday events: Fun for the whole family

From holiday markets to photos with Santa, there’s so much to do, see and experience during the holiday season. Our respondents enjoy getting out in the Winter Wonderland, with 76% indicating they want to attend one or more popular holiday events.

As mentioned above, we all know how the holidays can get overwhelming. Consumers need a little relaxation, whether with friends and family (70%), mastering those culinary skills, baking holiday desserts (35%), or me-time shopping (33%). The family fun doesn’t necessarily have to be holiday-themed, either. Our survey findings showed that 23% plan to go to the movies! (Well, they could choose to see a Christmas movie.)

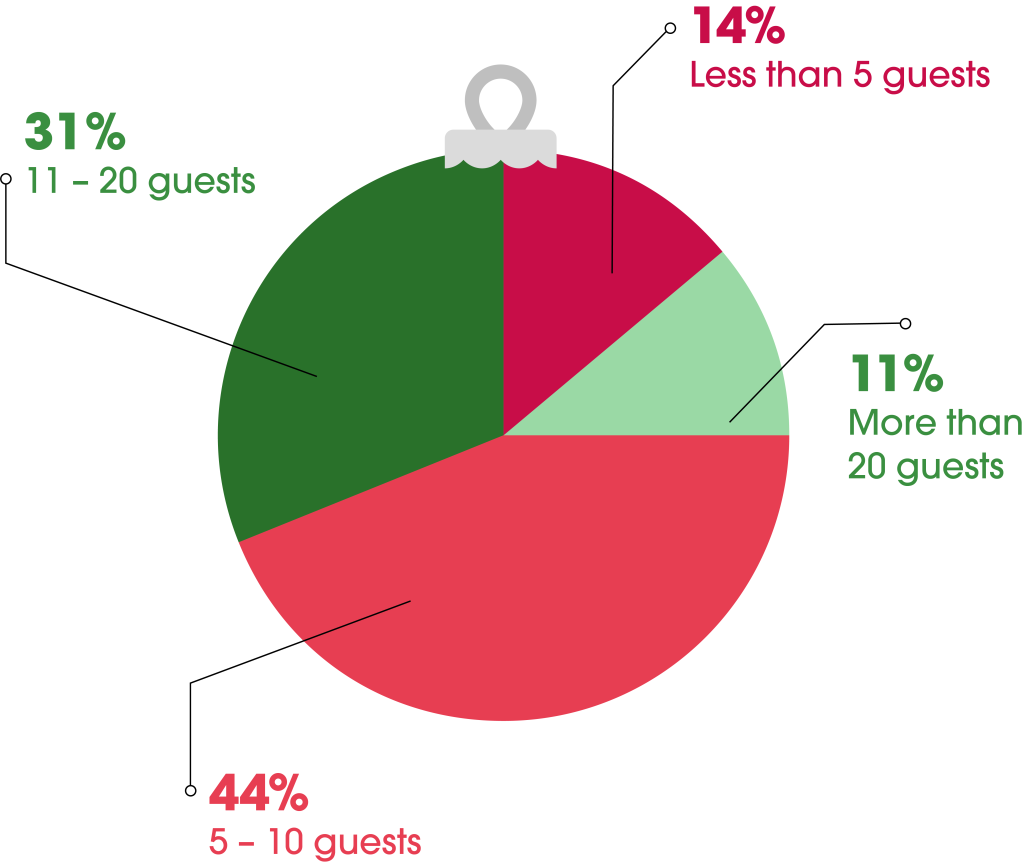

Holiday entertaining and hosting

However, some plan to spend that money creating and providing events and doing it in-house, i.e., bringing the party home, as 47% of survey respondents plan to host a holiday party this year. Meanwhile, when hosting holiday guests, they are gearing up to go BIG and will need lots of supplies and services to do it justice. A healthy 42% plan to host more than 10 guests, including family that raises many needs such as chips, dips, decorations, catering, games, you-name-it services (and then some) that will be needed to pull it off right.

Who’s on the holiday guest list?

In total, 49% plan to spend $100 or more on holiday entertaining, with 37% planning holiday budgets of over $250.

Get more holiday sales with Valpak

Knowing the shopping behaviors of your target audience, what motivates them to try a new business and which offers generate the best response is critical to your upcoming holiday advertising success. But there is more work to do to ensure your direct mail and digital marketing campaigns sleigh this holiday season.

From postcards to display ads, your local Valpak marketing team can help determine which channels are the best fit for your business, the ideal reach and frequency for your ad campaign and more.