Want to Know What Consumers Really Think? We’ve Got You Covered!

Nationwide, when consumers discuss insurance coverage, two things often dominate the conversation: cost and types of coverage. Life has many surprises, everything from pandemics to the sudden loss of valuables, and it feels good to know that someone has your back and you are protected. Valpak collected data from over 1600 U.S. adults, and while it’s no shock that along with coverage, what’s first and foremost on consumers’ minds is rates, that out-of-pocket that needs to be paid to homeowners and car insurance companies to maintain coverage and peace of mind.

Key Insights For Home & Auto Insurance Companies:

- 90% of homeowners and 91% of drivers are “satisfied” with their insurance policy / provider

- 53% of homeowners & 47% of drivers said their policy cost went up the last time it renewed

- The top motivator to switch providers for both home and auto is a lower rate (tied at 58%)

- Top requested discounts: Loyalty for homeowners (50%), safe driving for drivers (39%)

Irate? About My Insurance Rate

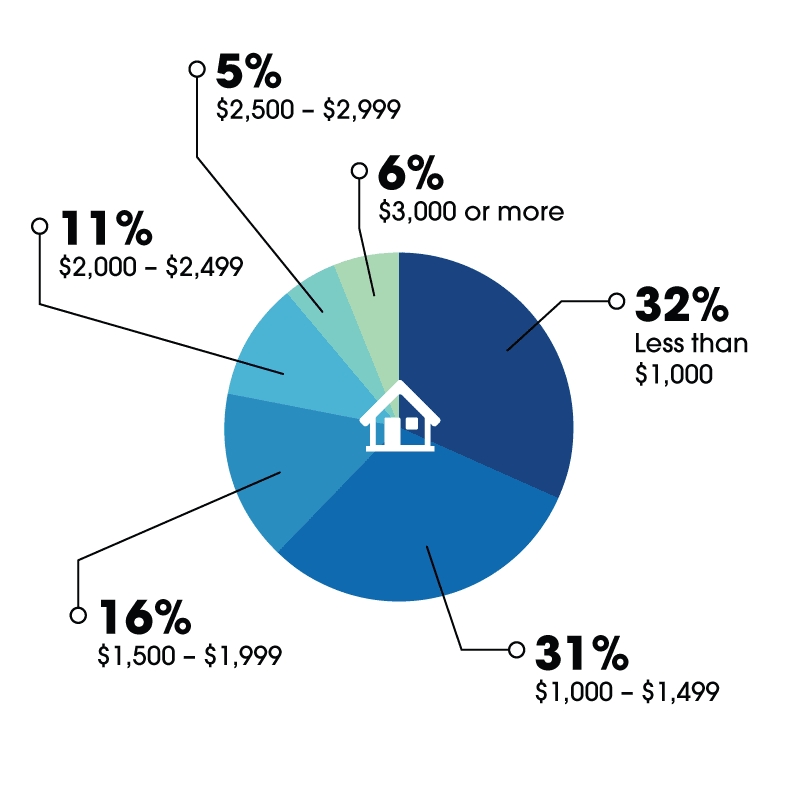

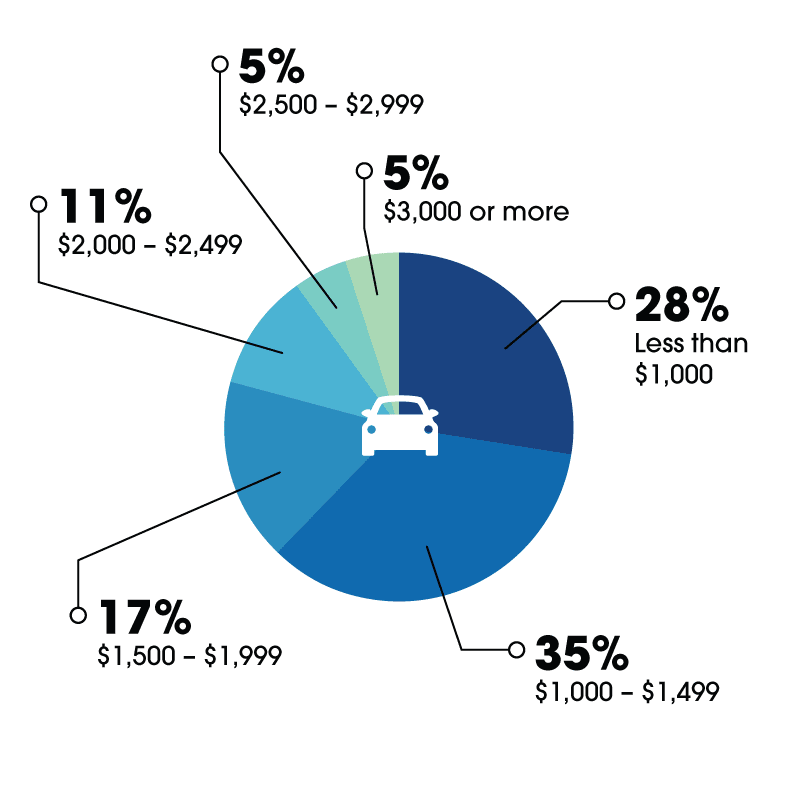

Despite the cost of coverage and rate increases (see next section), 9 out of 10 consumers are satisfied with their current home and auto insurance. How much are they paying for insurance premiums, you ask? 22% of homeowners said they shell out $2,000 or more per year to insure their homes, while 21% of drivers pay the same amount or more annually for auto insurance. Combined that’s $4,000 or more a year for coverage!

How much do you spend on homeowners insurance per year?

How much do you spend on auto insurance per year?

Up, Up And Oh, Wait!

“I’m frustrated with insurers significantly increasing my rate after the first year. They increase it, I switch companies, and the new company does the same thing. So I get a new quote from the first company and …what do you know? It’s back as low as it was in the first place. I hate that I can’t stay with one company, but I can’t find one that won’t jack up the rates every year.”

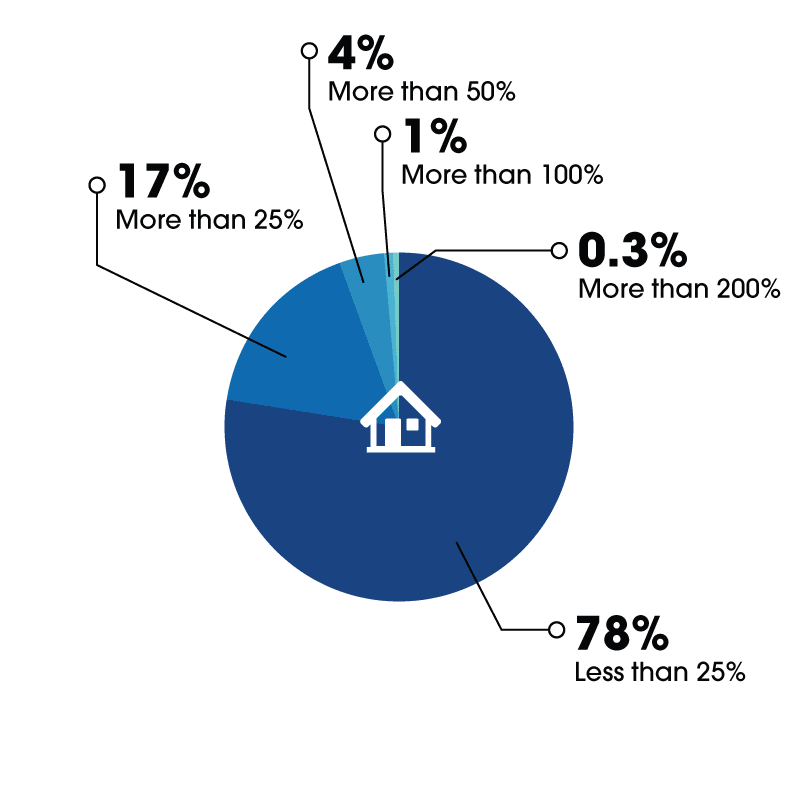

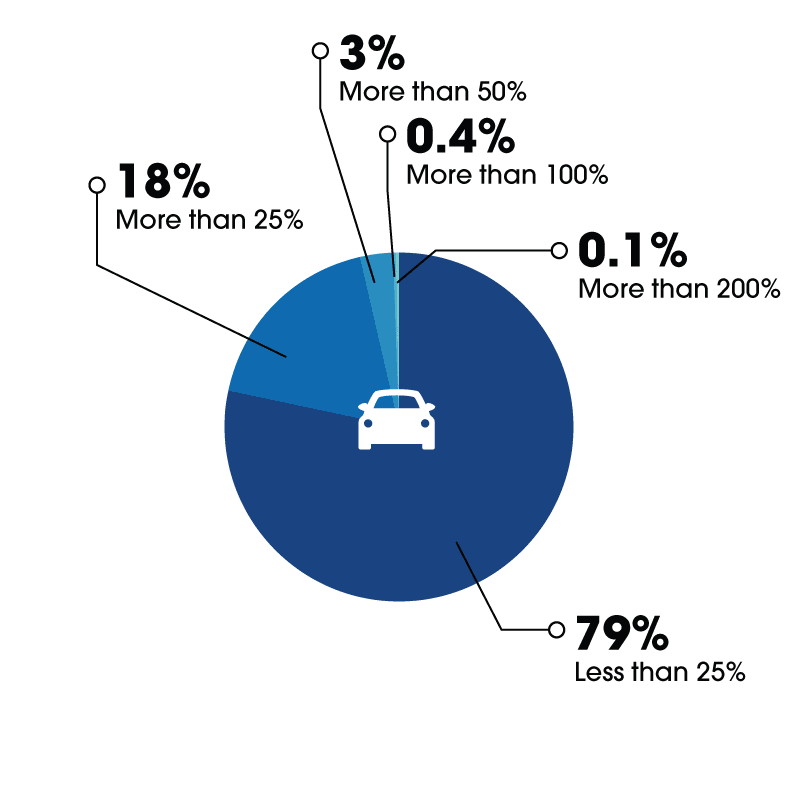

They say that two things are absolute in life: death and taxes. Maybe it’s time insurance costs going up get added to that truth, as both homeowners and drivers reported that their home insurance policies and auto policies went up with the last renewal. 53% of homeowners and 47% of drivers marked yes to this question, but by just how much? Well, here’s some food for thought: 17% of homeowners and 18% of drivers said their costs increased more than 25%!

How much did your homeowners insurance cost go up?

How much did your auto insurance cost go up?

Got You Covered

“Insurance companies seem to be raising rates on policies like car insurance to make up for shortfalls in other areas like homeowners’ insurance due to all of the disasters occurring in the U.S. Fewer people can afford insurance of any kind, leaving them vulnerable. They need to come up with policies that perhaps don’t have as much coverage, but that people can afford without a huge deductible.“

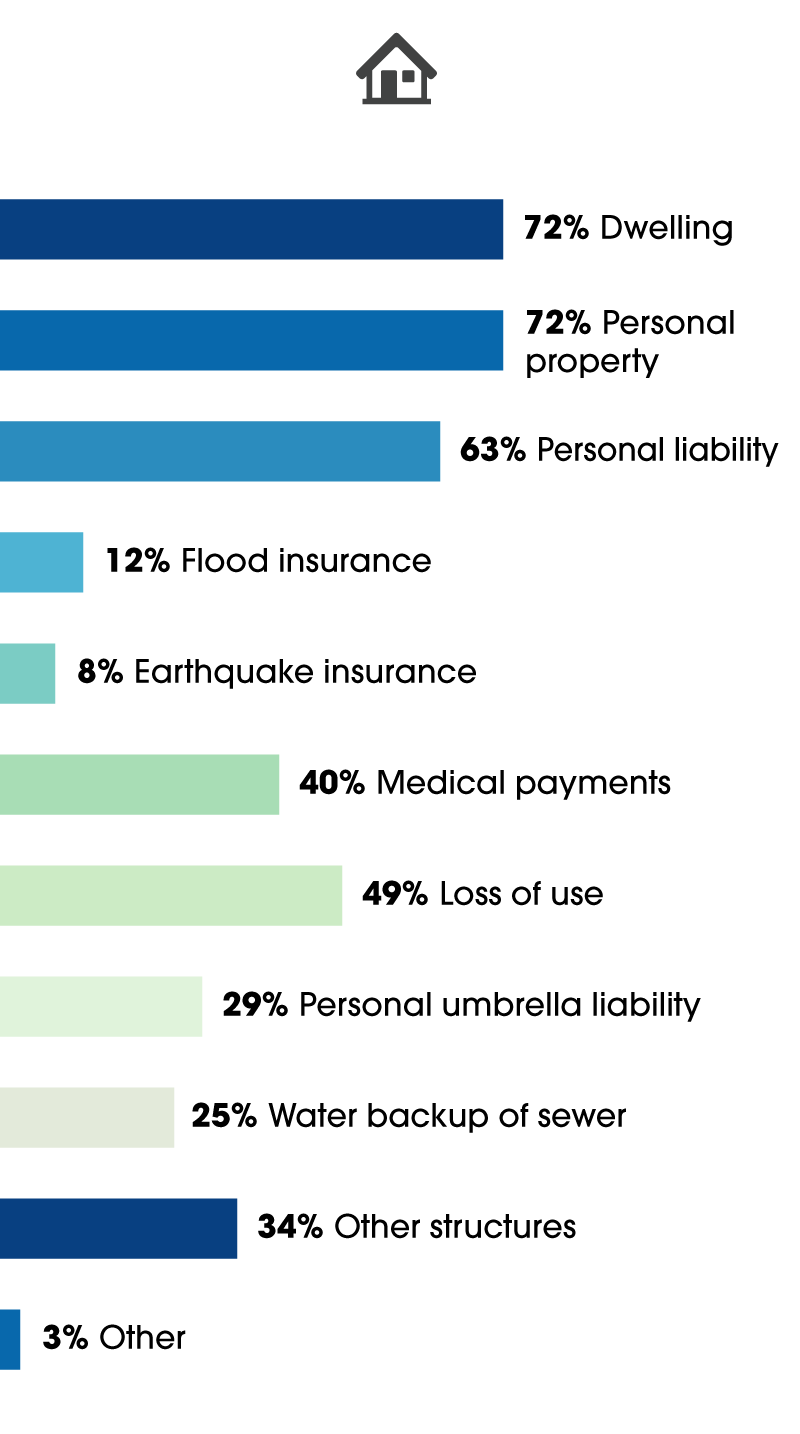

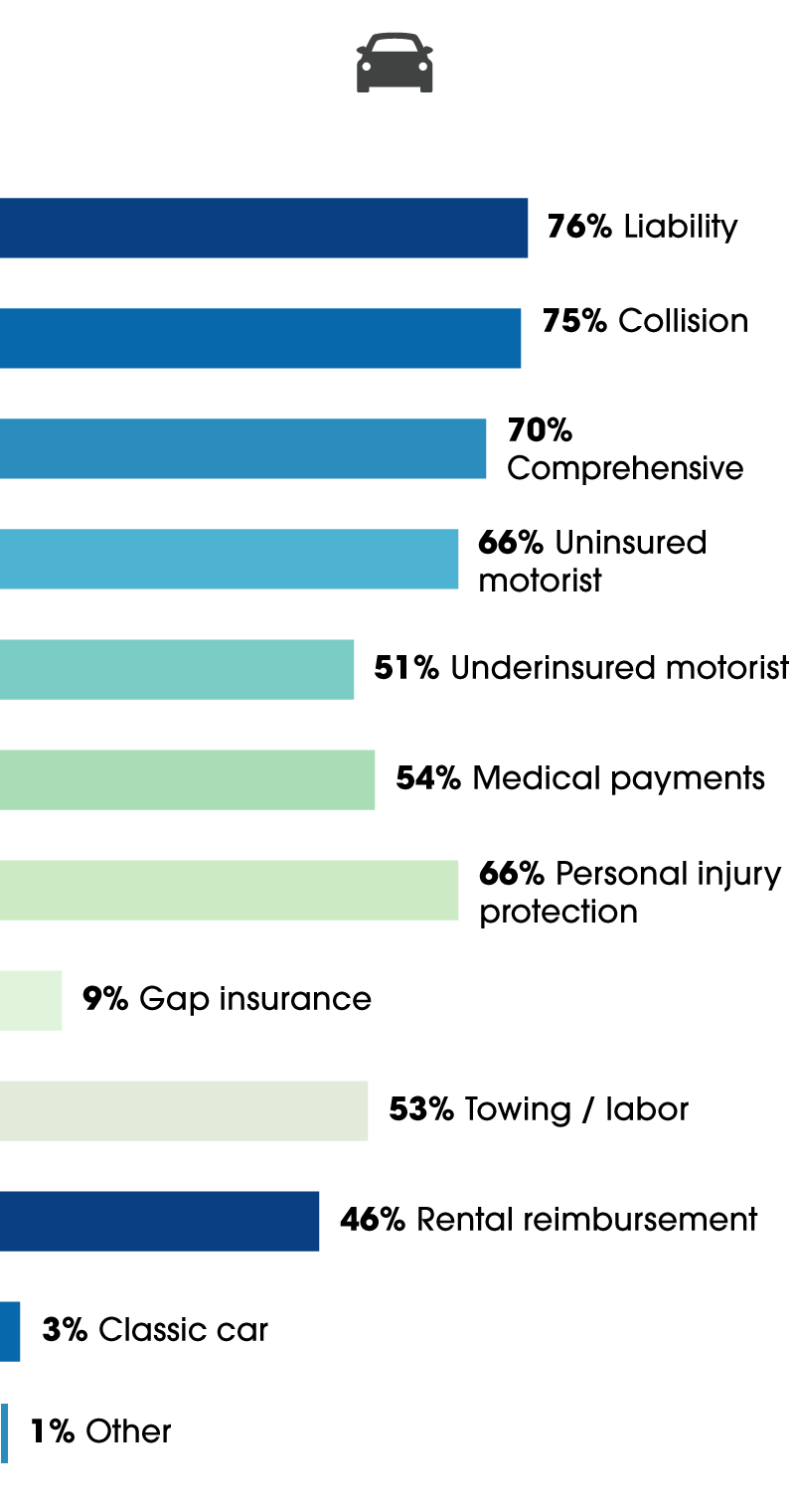

Having a lot of things that insurance covers is a good thing, but is there too much coverage? Too much on the menu that would lower costs if left out? For homeowners insurance coverage, consumers believe, “the more, the merrier,” as there are so many things these days that can go wrong; the same sentiment is echoed in car insurance.

For homeowners insurance, what is included in your policy, things like dwelling, personal property, personal liability, loss of use, medical payments, and more, come to mind. And then, when you’re out on the road or your car is just parked, what protection does it and you have: liability coverage, collision, uninsured motorist, medical payments, and rental reimbursement are a few things that also need to be addressed when choosing insurance.

Which of the following coverage is included in your homeowners insurance policy?

Which of the following coverage is included in your auto insurance policy?

Should I Stay, Or Should I Switch?

“Insurance. You have to have it. But it just gets more and more expensive. The only way to save money on it is to change companies or complain.”

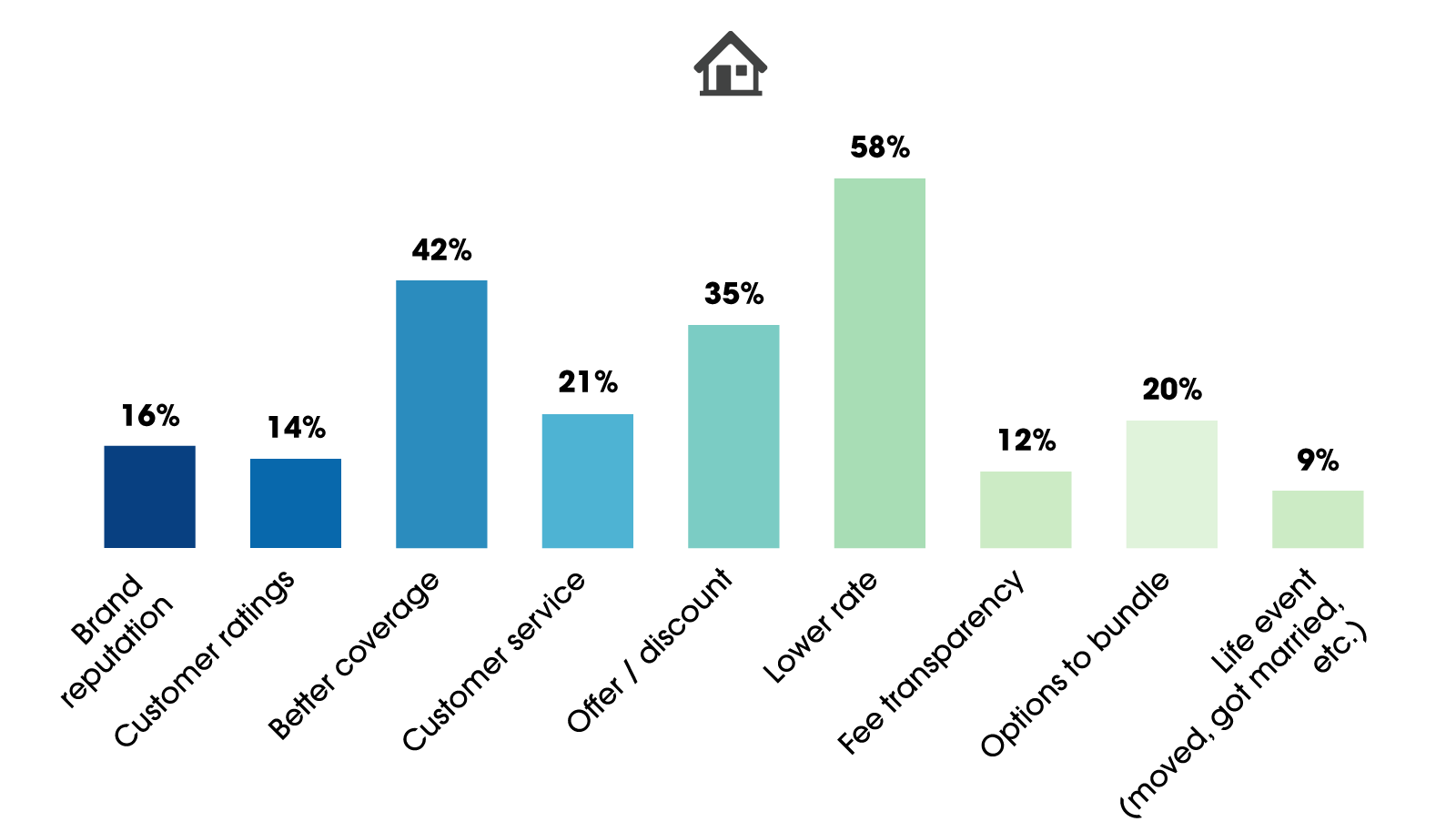

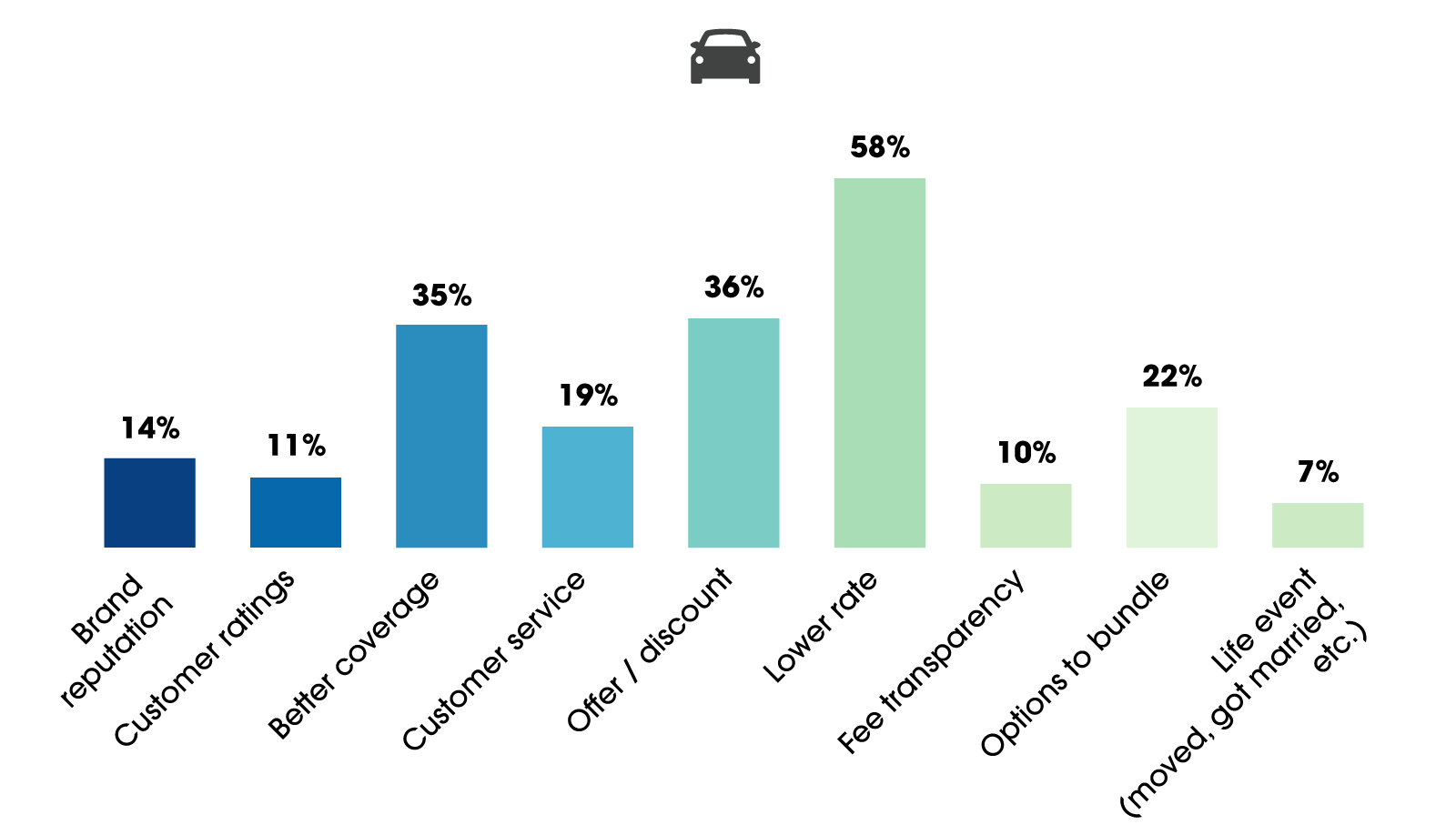

It’s hardly a surprise that homeowners and drivers chose a lower rate as the #1 motivating factor to switch insurance providers (58%). 42% of homeowners also want better coverage (drivers agreed at 35%) while 35% (36% for auto) would be tempted to jump for the right offer or discount.

What would motivate you to switch home insurance providers?

What would motivate you to switch auto insurance providers?

We Want What We Want

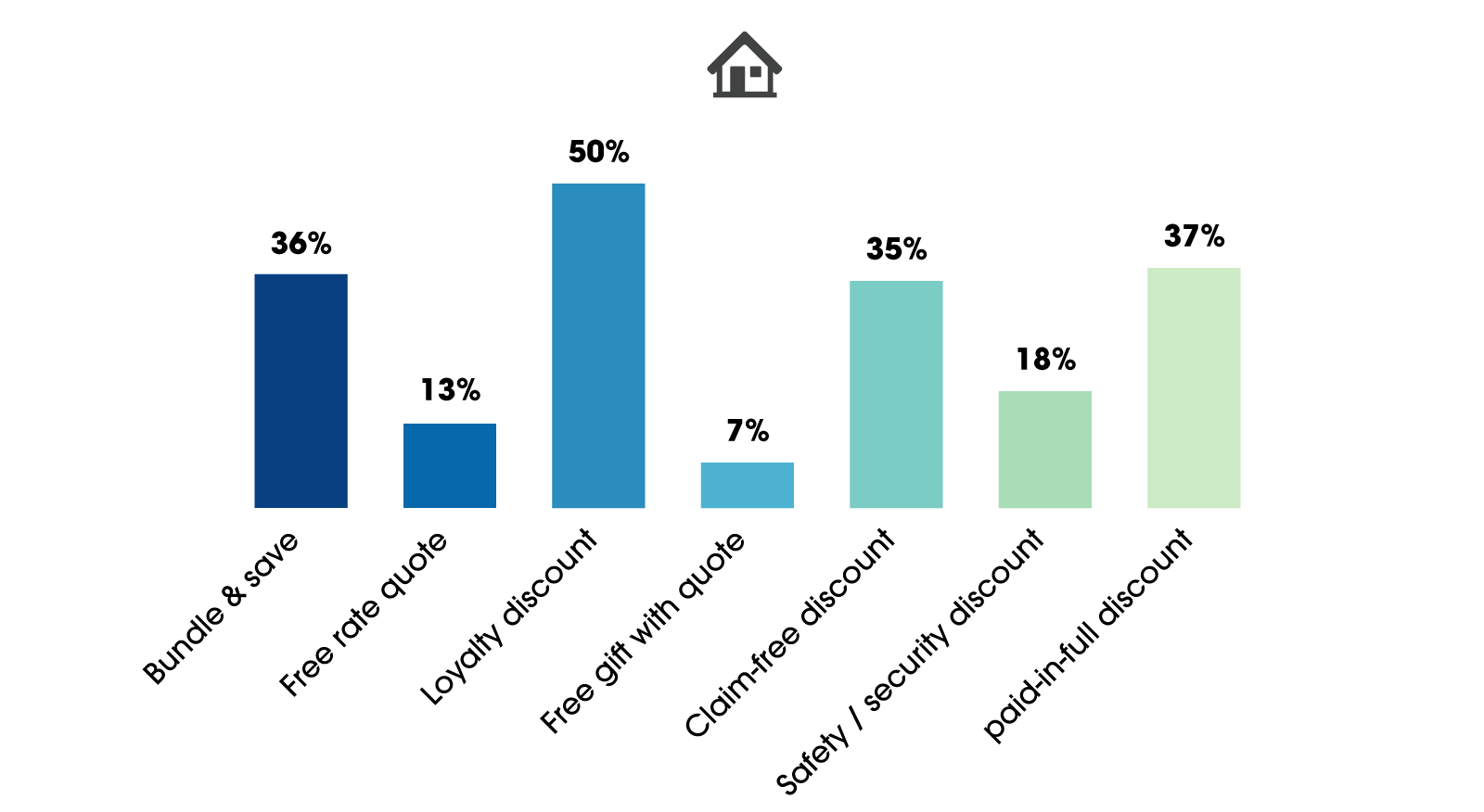

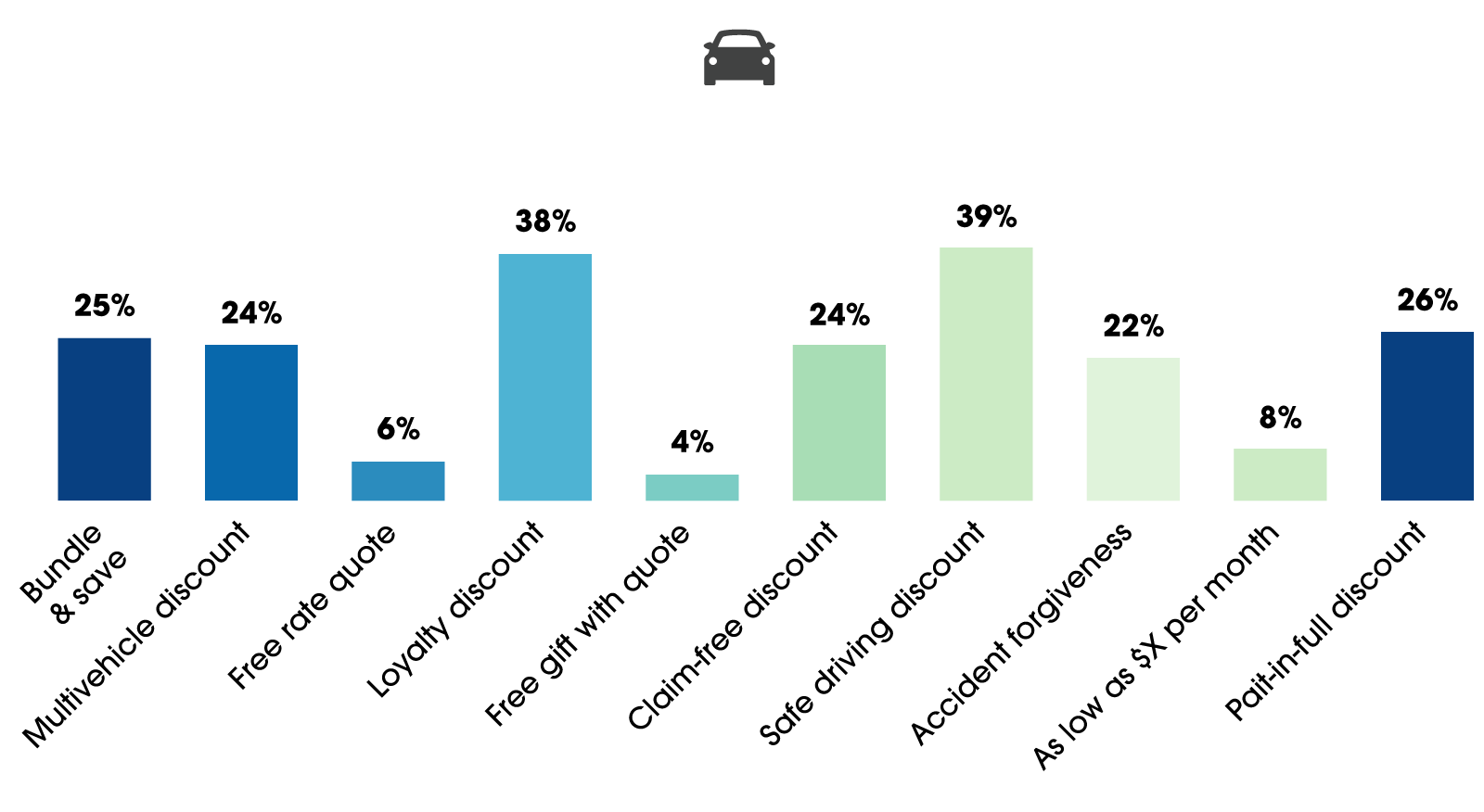

And most people want a good deal. 50% of homeowners would like to receive a loyalty discount and 37% want to save by paying for coverage in full. 39% of auto policyholders would like a reward for safe driving, while 38% also wanting a discount for loyalty to their insurance provider.

Which of the following home insurance offers would you most like to receive?

Which of the following auto insurance offers would you most like to receive?

More To Your Stack

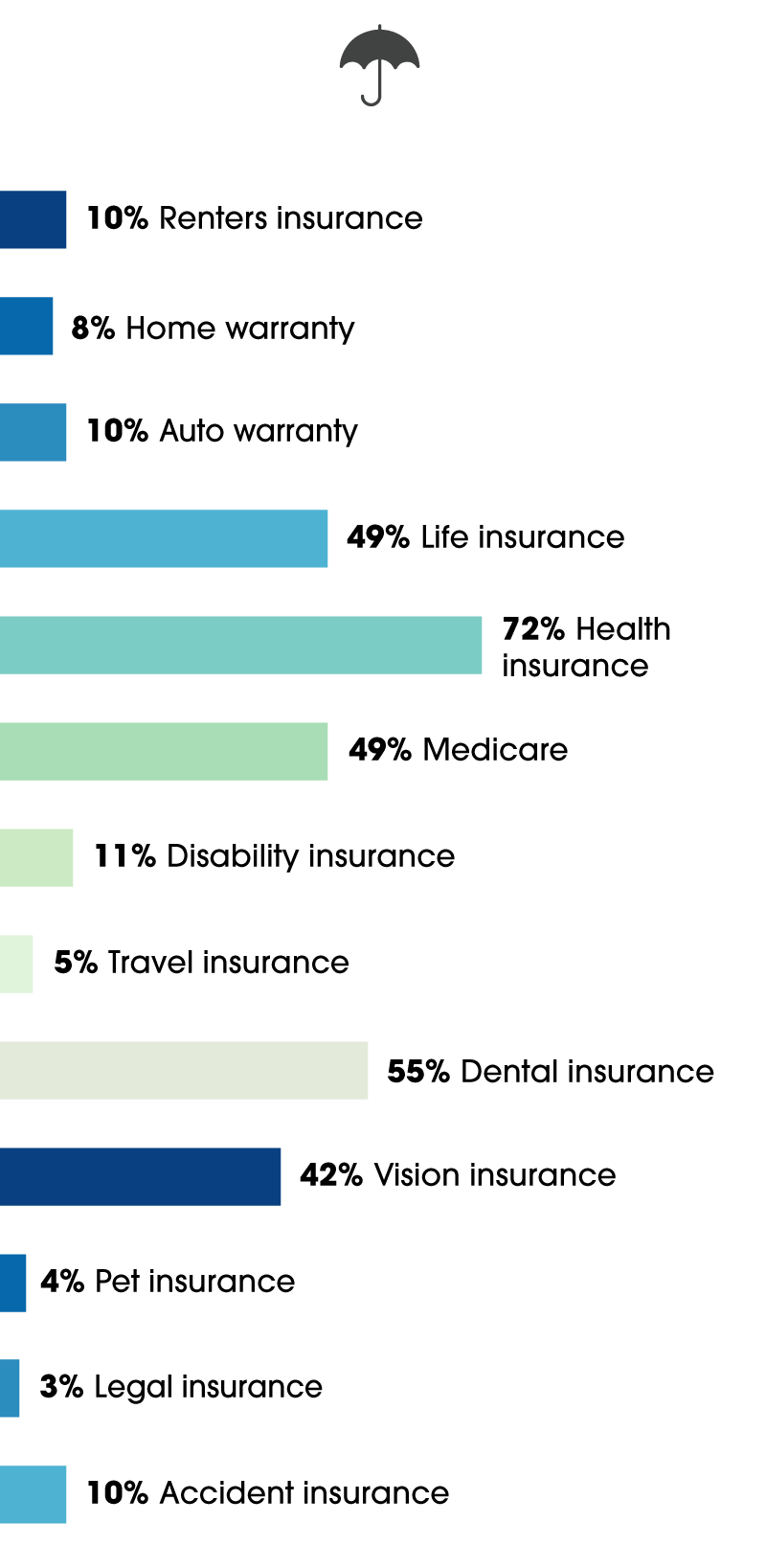

Insurance claims and insurance products are everywhere, but really, what do you need? It’s good to be covered because you never know—whether it’s mere chance or a wrong decision, things such as natural disasters, medical mishaps and property damage unfortunately happen, so it’s good to be prepared and to know your coverage limits. There are many additional types of insurance out there, so we asked our respondents which ones they are covered by. It’s clear from the results that consumers have a wide variety of policies, from renters insurance to life insurance, in their yearly /monthly budgets.

Do you have any of the following additional types of coverage?

Ensure Your Insurance Sales With Valpak

Insurance is like carrying an umbrella around all the time just in case it rains; in the back of your mind, you know you’ll be covered when and if it does. Auto and home insurance companies that advertise with Valpak reach an audience that spend 22% more on homeowners insurance and 9% more on vehicle insurance.

Whether shared direct mail, postcards or combining and boosting your campaign strategy with digital marketing, your local Valpak rep can help your business decide which channels (like social media ads) are the most suitable for your needs to achieve your advertising goals.

If you’re unable to view or scroll the PDF, click here.